Invictus Tariff and Trade War Recession Scenario

The Invictus Tariff and Trade War Recession 2.0 scenario (updated August 19, 2025) is intended to reflect (but not predict) a tail-risk outcome for the U.S. economy, driven by...

With the right approach, the potential Return on Investment (ROI) from pandemic stress testing is quite significant. Most community banks treat stress testing as a check-the-box exercise when they should be viewing it as a strategic one. As a result, this naturally leads them to think about stress testing as an expense instead of an investment.

Since we are in a belt-tightening period as community banks struggle with declining profitability from NIM compression and rising credit costs, many banks will make the mistake of being penny-wise and pound-foolish with stress testing.

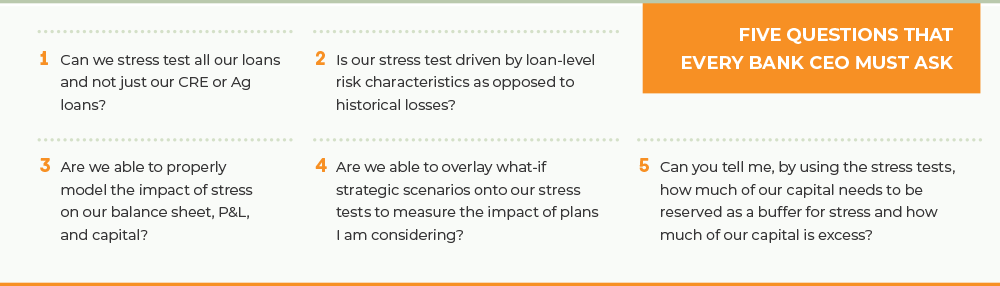

For a pandemic stress test to produce an ROI, it must have certain capabilities. In March, I posed five questions that every bank CEO must ask the person in charge of stress testing. If any answer is “no,” then the bank’s stress testing is an expense weighing down profits, not an investment unlocking value.

Unfortunately, most stress testing systems in the industry fail the ROI test. Loan-level stress tests focused on shocking the net operating income on CRE loans are problematic in good times and virtually useless in a pandemic. Top-down stress tests are even worse, and risk providing management and the board with a false sense of comfort or concern.

However, stress testing can be one of the best investments a bank can make, especially now. If you don’t want to leave money on the table, read on for a summary of the primary drivers of ROI that a properly designed stress testing system can provide:

“Examiners should determine whether management’s assessment of credit risk reasonably reflects the institution’s asset quality, given the prevailing economic conditions in its business markets…examiners should assess management’s understanding of the pandemic’s effects on the institutions earnings prospects and capital adequacy.”

— Interagency Examiner Guidance for Assessing Safety and Soundness Considering the Effect of the COVID-19 Pandemic on Institutions

At the end of the day, it’s all about trust. Can the regulators trust your bank to manage risk and capital? If the answer is no, that’s when exams end with MRAs, MOUs, and consent orders. These types of regulatory actions can cost hundreds of thousands, if not, millions of dollars. The most visible way these costs manifest themselves is by having to spend excess money on compliance and lawyers. But the real killer more often comes from the constraints regulatory actions can have on loan growth, deposit costs, and reputation.

Stress testing can be an extraordinarily powerful tool to help banks demonstrate they have full command over risk and capital. In fact, if done properly, it can often make the difference between receiving and avoiding an MRA, as one banker recently experienced.

Optimizing your capital is critical now because disruptive environments also produce the most opportunities. Market share standings will shift, with some banks paralyzed by the post-pandemic economy and others in a position to pounce. Customers will change hands. Talent will move. M&A will accelerate. Stress testing can not only provide the capital to fuel these offensive actions, it can also outline which path your bank should take to target specific opportunities, giving you crucial documentation to take to your board and regulators.

“In assessing whether the ALLL or ACLs are appropriate, examiners will assess whether management has considered relevant available information about the collectability of the institution’s loan portfolio, along with any changes to the institution’s lending practices and economic conditions as a result of the pandemic. Examiners should evaluate how an institution considered the effect of the pandemic in its ALLL or ACLs estimation process, as applicable, and whether the resulting estimates are in conformity with GAAP and regulatory reporting requirements. Additionally, examiners will assess management’s process for updating estimates of loan losses in the ALLL or ACLs, as applicable, as the institution obtains additional information.”

— Interagency Examiner Guidance for Assessing Safety and Soundness Considering the Effect of the COVID-19 Pandemic on Institutions

Wrap Up

When you begin adding up even conservative estimates, the ROI for pandemic stress testing becomes clear. The benefits, both in terms of earnings created and earnings preserved, dwarf the costs of implementing a well-designed stress test.

Community banks have a choice: They can minimize expenses by taking a check-the-box approach toward stress testing, or they can generate a significant ROI by viewing stress testing as an investment. If you choose the latter approach, just make sure that your stress testing has all the capabilities necessary to unlock these massive returns.

[1] The CBLR is temporarily at 8 percent per the CARES Act but returns to 9 percent in phases by January 1, 2022.

CECL Trends, CECL, community bank regulations, community banks, CECL Modeling, acl challenges, bank regulatory compliance, advanced cecl

Now that most community banks have eight to ten quarters of CECL experience under their belts, many are still grappling with foundational issues such as overreliance on qualitative factors, lack of responsiveness to risk rating...

capital planning, community bank regulations, Deregulation, bank strategy, community banks, regulatory capital, bank growth strategy, cre risk

Author : Adam Mustafa, CEO, Invictus Analytics

Community banks now have the clearest path in nearly two decades to reshape their regulatory capital requirements—and they shouldn't miss it. While most recent efforts to ease...