Invictus Tariff and Trade War Recession Scenario

The Invictus Tariff and Trade War Recession 2.0 scenario (updated August 19, 2025) is intended to reflect (but not predict) a tail-risk outcome for the U.S. economy, driven by...

CECL models that do not involve stress testing are useless and a waste of time. You will only find yourself in the exact place you are now: unable to quantify much of your reserve due to lack of loss history and overly relying on qualitative factors by throwing darts at the proverbial board.

The reason for this is simple: Banks simply do not have material loan losses in “good times.” The inverse of this is also true. Banks are most likely to experience material loan losses in “bad times.” If that is the case, then banks need a tool that will estimate what losses could look like if “bad times” rear their ugly head.

This is where stress testing comes in as the perfect and only tool for the job. Stress testing, by definition, assumes that the “bad times” happen. When running severe stress scenarios comparable to the pandemic stress tests the Federal Reserve required from the large banks in September, you will undoubtably wind up with a large estimate of loan losses.

However, what we do NOT know with a high degree of certainty is the probability of “bad times” actually happening. The probability of a given stress scenario occurring is unknown and difficult to gauge, but it is greater than 0 percent and less than 100 percent. At the end of the day, the estimated probability of a recession occurring is in the eye of the beholder.

Under CECL, bank management is expected to make a forecast for the reasonable and foreseeable future to properly calibrate the loan loss reserve. Instead of getting overly bogged down in having to make a forecast for key macroeconomic indicators such as GDP and unemployment, management can instead boil down their forecast into the probability of stress scenarios occurring.

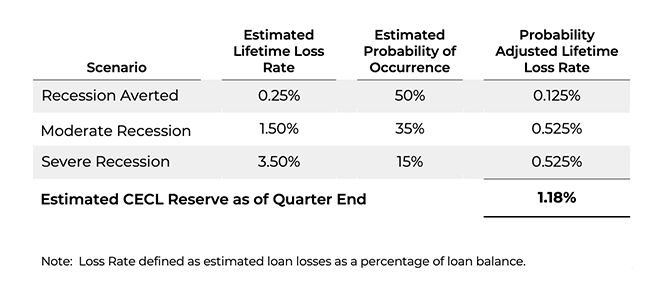

That makes quantifying your loan loss reserve a simple process. CECL is nothing more than a probability-adjusted stress test. Let’s walk through an oversimplified example. Assume you calculate your estimate for loan losses under the following three scenarios:

Now the math is uber simple. You calculate the weighted average of the three scenarios and arrive at a CECL Reserve equal to 1.18 percent of your loan balance. However, unlike your incurred loss model, you do not need to overly rely on qualitative factors. You have quantified your entire reserve.

The problem with most existing incurred loss and CECL models is that they are overly focused on scenarios comparable to the “Recession Averted” one, but that is the scenario that also yields very few losses. However, with this recommended approach, nearly 90 percent of the entire reserve is driven by the sum of the two stress scenarios (equal to 0.525% + 0.525% divided by 1.18%).

The beauty of this approach, besides its simplicity, is that management can easily adjust the probability weights from one quarter to the next. If overall economic sentiment improves, management can adjust their weights by increasing the probability of the Recession Averted scenario and decreasing the probabilities of the two stress scenarios, and vice versa.

Even in the best of times, there is always some probability of an unexpected downturn occurring. In just about every plausible combination of probability weights the two stress scenarios will equate to at least 75 percent of the estimated CECL reserve.

There is no such thing as a CECL model that does not include a stress test as its centerpiece. Or at least a good CECL model, that is. This is a lesson that many current CECL filers are learning the hard way, despite being warned over two years ago. Hopefully the 2023 class can see the forest for the tress and not follow in their footsteps.

CECL Trends, CECL, community bank regulations, community banks, CECL Modeling, acl challenges, bank regulatory compliance, advanced cecl

Now that most community banks have eight to ten quarters of CECL experience under their belts, many are still grappling with foundational issues such as overreliance on qualitative factors, lack of responsiveness to risk rating...

capital planning, community bank regulations, Deregulation, bank strategy, community banks, regulatory capital, bank growth strategy, cre risk

Author : Adam Mustafa, CEO, Invictus Analytics

Community banks now have the clearest path in nearly two decades to reshape their regulatory capital requirements—and they shouldn't miss it. While most recent efforts to ease...