Invictus Tariff and Trade War Recession Scenario

The Invictus Tariff and Trade War Recession 2.0 scenario (updated August 19, 2025) is intended to reflect (but not predict) a tail-risk outcome for the U.S. economy, driven by...

The Invictus Severe Stagflation scenario tests conditions under the simultaneous occurrence of a severe global recession and aggressive monetary policy that includes rapid and substantial increases in the Fed Funds Rate and accelerated quantitative tightening in response to persistent inflation that remains well above market expectations.

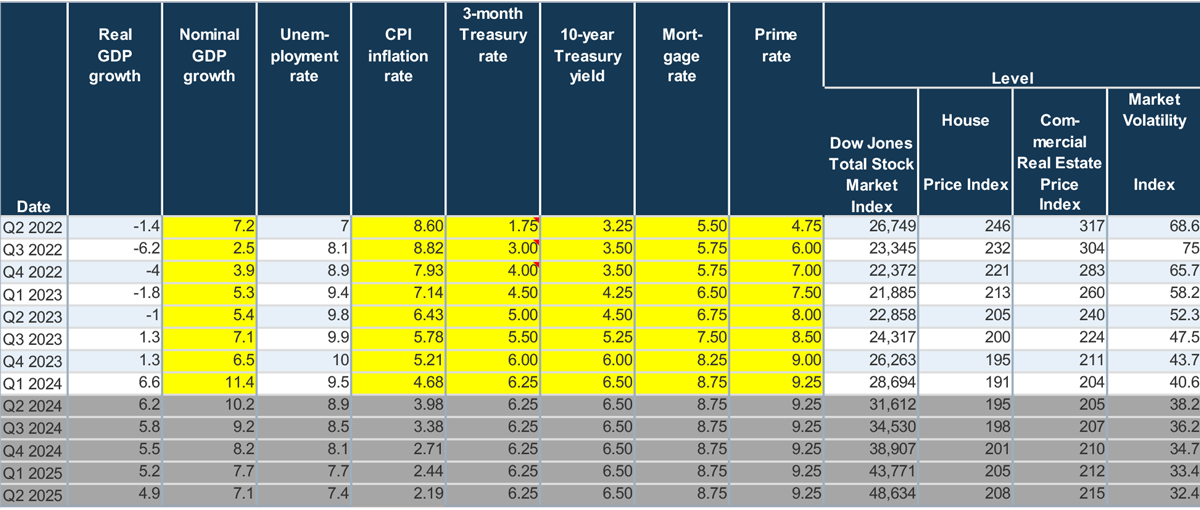

This scenario includes a quarterly forecast for selected variables based upon current economic conditions, trends observed from the last U.S. stagflation period between the late 1970s and early 1980s and educated judgment (See Exhibit 2). We do not opine on the probability of this scenario occurring and recognize that there are many variations of a stagflation scenario that could occur, including those that are less severe.

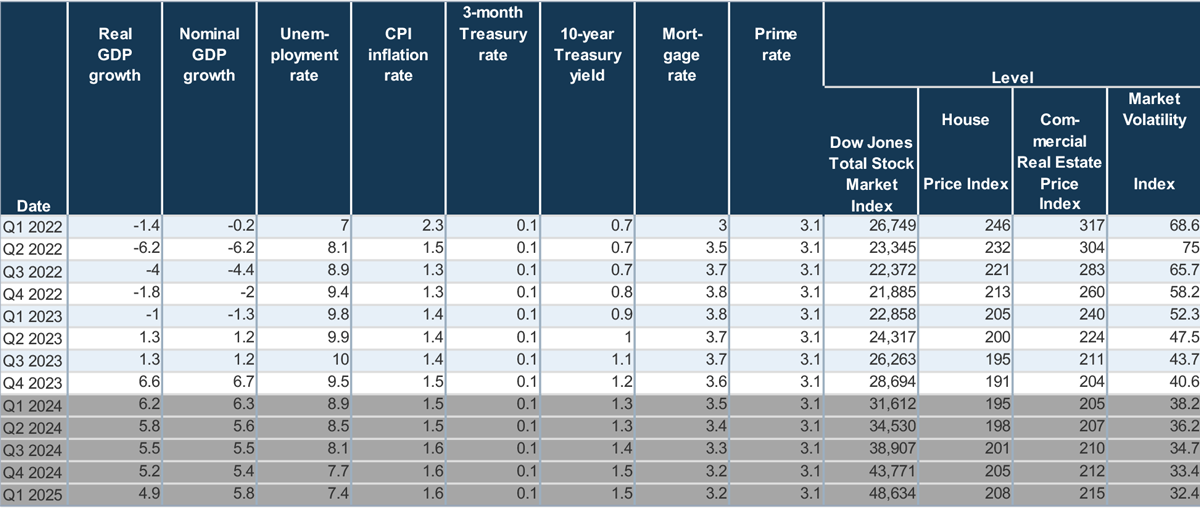

The Invictus Severe Stagflation scenario matches the Federal Reserve’s 2022 Comprehensive Capital Analysis and Review (CCAR) prescription for declining real GDP, rising unemployment, and declining housing and commercial real estate values. In other words, the Invictus Stagflation scenario assumes a comparable “bottom” as CCAR 2022, but also assumes the path to the bottom is very different since it is driven by inflation and Fed policies.

However, nominal GDP, the CPI inflation rate, 3-month Treasury yield, Mortgage Rate, Prime Rate, and 10-year Treasury yield all project to be significantly higher than CCAR 2022. For more information, please see Exhibit 1 for the macroeconomic factors in CCAR 2022 and Exhibit 2 for the macroeconomic factors in the Invictus Severe Stagflation Scenario .

In our scenario, the annualized CPI inflation rate continues to grow and peaks at 8.8 percent before gradually declining. In response, the Federal Reserve increases the Fed Funds rate and reduces the size of its balance sheet at a greater magnitude and velocity than anticipated by market participants.

The 3-month Treasury rate, a proxy for the Fed Funds rate (which is not included as a variable in CCAR), is expected to rise by 625 basis points since the beginning of 2022. This includes the assumption of several 50-basis point and 75-basis point rate hikes. The overarching concept is that the Federal Reserve would have to raise the Fed Funds rate close to and perhaps above the inflation rate to create a positive real interest rate environment to effectively combat inflation.

This eventually leads to a de-acceleration of the CPI inflation rate that regresses close to the Fed’s 2.0 percent long-term target by early 2025. The 10-year Treasury rate projects to further increase due to changing market expectations about long-term inflation and quantitative tightening (QT) by the Federal Reserve, which increases the supply of longer-term Treasuries. The spread between the 10-year and 3-month Treasury rates projects to eventually flatten and modestly invert as market participants seek a flight to safety.

The Prime Rate is assumed to have a 300-basis point spread over the 3-month Treasury rate for simplicity. The mortgage rate is assumed to have a 225-basis point spread over the 10-year Treasury rate, also for simplicity. Nominal GDP is calculated as a function of the real GDP forecast assumed from CCAR 2022 and the forecasted CPI inflation rate (used as a proxy for the GDP deflator). While annualized real GDP growth contracts over the first several quarters, nominal GDP growth remains positive throughout the forecast horizon because of inflation.

CRE prices were left unchanged versus CCAR 2022. However, the narrative behind the decline is different. The Invictus Severe Stagflation scenario assumes higher NOI levels due to higher rental rates resulting from inflation versus CCAR 2022. However, the favorable impact from higher NOI on property values is offset by the assumption of higher cap rates versus CCAR 2022 because of higher interest rates.

Fixed-rate loans are assumed to be stressed with the same characteristics as CCAR 2022 in terms of risk rating migration, probability of default, and loss given default. However, loans with balloon payments due that are set to mature within the stress horizon will be treated as having a higher refinance risk than CCAR 2022 because the rightsizing of interest rates to the market will further exacerbate borrowers’ debt-service coverage challenges.

Certain variable rate loans will be stressed with more aggressive risk rating migration and probability of default assumptions based upon how and when they re-price to reflect the impact of elevated debt-service requirements occurring at the same time as deteriorating macroeconomic conditions.

Replacement loans that are created to keep the balance sheet flat would come on at higher rates.

Interest income will be adversely affected by an increase in non-performing variable rate loans relative to CCAR 2022. However, interest income will also benefit from higher interest rates on loans, securities, and cash balances.

Interest expense is also expected to increase with rising interest rates, as are loan-to-deposit ratios due to the quantitative tightening projected in this scenario.

Certain fee income streams may also be adversely impacted and will be discussed with clients on a case-by-case basis. For example, rising mortgage rates in tandem with rising unemployment and declining house prices should materially affect the gain on mortgage sales but may also lead to higher valuations on mortgage servicing rights.

Gains and losses on securities sales may also have a material impact on pre-provision earnings. This is discussed in the next section.

Both the available-for-sale and held-to-maturity securities portfolio will be stress tested for both interest rate and credit risk. However, since most community banks opted out of their accumulated other comprehensive income (AOCI) from counting as Tier 1 regulatory capital, any estimated capital at risk from the stress tests of the securities portfolio needs to be tested further for “realization risk.” Realization risk is defined as the likelihood the bank would have to sell some securities at a loss to fund any liquidity needs, most notably, any unexpected flight of deposits from the bank that cannot be covered by excess cash or cash equivalents as well as principal payments on maturing loans and securities.

In the Invictus Severe Stagflation scenario, the flight risk of deposits is elevated because QT is expected to remove surge deposits from the banking system and reverse the gains to the M2 money supply that was created from quantitative easing during the pandemic. This is in addition to natural disintermediation of deposits that occurs in a rising interest rate environment as customers shift into higher yielding products or remove funds from the bank altogether.

A 30-day Liquidity Coverage Ratio stress test would be performed to estimate the liquidity needs of the bank under this scenario. Any shortfalls would be assumed to be covered by liquidating certain AFS securities at a loss. That loss estimate would be treated as a realized loss in the stress test that would flow through the P&L and reduce regulatory capital.

The Invictus Severe Stagflation scenario is designed to be more relevant to existing economic conditions than CCAR 2022.

This scenario is not meant to serve as a ‘check-the-box” exercise and regulators are not asking banks to run such a scenario. By running this scenario, banks can demonstrate best-in-class risk management and capital planning capabilities to stakeholders. Banks can use this analysis to pre-empt questions and concerns about their securities portfolio, liquidity position, capital adequacy, and lending concentrations. Besides providing Management with valuable insights to support risk management and capital planning decisions, the purpose of the analysis is to help the Bank preserve or improve its CAMELS ratings.

Please contact Adam Mustafa @ amustafa@jamg23.sg-host.com for more information on the Invictus Severe Stagflation scenario.

Source: Table 3.A., “2022 Stress Test Scenarios,” Federal Reserve, February 2022.

Sources:

CECL Trends, CECL, community bank regulations, community banks, CECL Modeling, acl challenges, bank regulatory compliance, advanced cecl

Now that most community banks have eight to ten quarters of CECL experience under their belts, many are still grappling with foundational issues such as overreliance on qualitative factors, lack of responsiveness to risk rating...

capital planning, community bank regulations, Deregulation, bank strategy, community banks, regulatory capital, bank growth strategy, cre risk

Author : Adam Mustafa, CEO, Invictus Analytics

Community banks now have the clearest path in nearly two decades to reshape their regulatory capital requirements—and they shouldn't miss it. While most recent efforts to ease...