Invictus Tariff and Trade War Recession Scenario

The Invictus Tariff and Trade War Recession 2.0 scenario (updated August 19, 2025) is intended to reflect (but not predict) a tail-risk outcome for the U.S. economy, driven by...

Author: Adam Mustafa, CEO

Concerns surrounding liquidity and funding are poised to become a pressing issue for banks with concentrations in commercial real estate (CRE), drawing the attention of bank examiners, analysts, and investors. While the current spotlight is on credit risk associated with the CRE portfolio, there's a growing fear that these credit risks could swiftly transform into a liquidity crisis for certain banks. This is particularly true for banks that have expanded their CRE portfolio by more than 50 percent over the last three years and who have funded this growth with non-core sources of funding.

Credit issues can quickly trigger a liquidity crisis for a bank in several ways. Firstly, the Current Expected Credit Loss (CECL) accounting standard requires banks to recognize expected losses into the loan loss allowance much sooner than the previous incurred loss methodology. This faster build-up of reserves can put pressure on capital, as there are fewer earnings available to offset the impact of the reserve build.

If economic conditions deteriorate significantly, the accelerated building of the loan loss allowance under CECL could further strain capital levels. Since many banks with CRE concentrations, especially those with rapid growth, have lower initial capital levels, this could lead them to fall below the well-capitalized threshold. Falling below this threshold renders a bank ineligible to participate in the brokered deposit market without a waiver from regulators. This could pose significant challenges for banks heavily reliant on brokered deposits to fund the growth in their CRE portfolio over the last three years.

Reliance on advances from the Federal Home Loan Bank (FHLB) could present challenges for banks with CRE concentrations. While the FHLB requires banks to have positive tangible common equity to be eligible for advances, banks still need to pledge collateral. However, many banks with CRE concentrations are "loaned up" and may not have sufficient securities to pledge to the FHLB. Additionally, the FHLB may increase the haircuts on loans pledged as collateral if economic conditions or the bank's financial conditions worsen.

Liquidity challenges for banks with CRE concentrations could emerge well before loan loss provisions accelerate and capital levels come under pressure. Concerns about CRE and credit could shake the confidence of investors, analysts, and depositors, potentially leading to runs on the bank. The bank failures of 2023 demonstrated that money, news, and fear move much faster than in the past, with some banks experiencing significant deposit outflows and credit rating downgrades.

One key metric used by analysts is the ratio of brokered deposits and other borrowed money ("Brokered + OBM Ratio") as a percentage of total assets. This ratio provides insights into a bank's reliance on potentially volatile sources of funding.

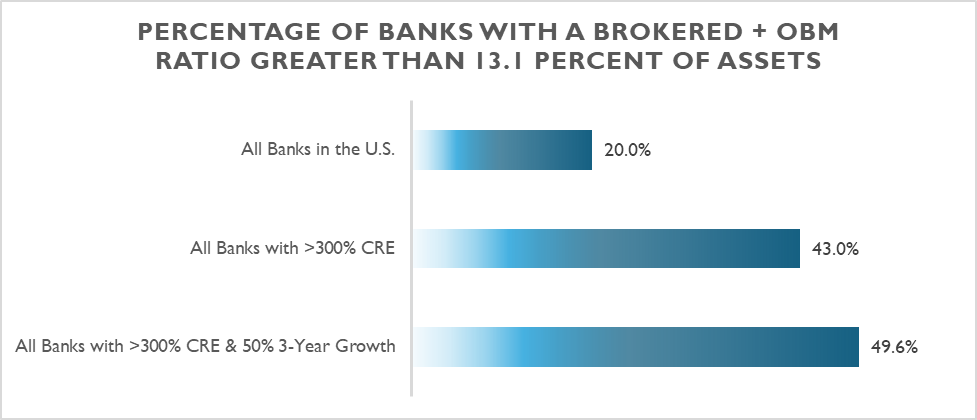

A recent analysis of banks across the country revealed some intriguing findings. The 80th percentile bank in the country has a Brokered + OBM Ratio of 13.1 percent, indicating that only 20 percent of banks have a higher ratio. This serves as a benchmark for identifying banks with relatively high levels of reliance on brokered deposits and other borrowed money.

However, when focusing specifically on banks with concentrations in commercial real estate (CRE), the picture changes significantly. Among these banks, a staggering 43 percent have a Brokered + OBM Ratio greater than 13.1 percent. This highlights a higher propensity for banks with CRE concentrations to rely on these types of funding sources.

Digging deeper into this subset of banks, those that have grown their CRE loan book by more than 50 percent over the past 36 months stand out. Among this group, 49.6 percent have a Brokered + OBM Ratio greater than 13.1 percent. This finding underscores the link between aggressive growth strategies in the CRE sector and increased reliance on brokered deposits and other borrowed money.

Concentrations in brokered deposits and FHLB advances have other consequences. Both represent two of the most expensive sources of funding for banks, which can serve as a headwind for net interest margins and earnings. This poses a challenge for banks, as earnings are often the primary source of capital available to offset credit losses, especially if the Federal Reserve maintains a "higher for longer" stance on interest rates due to inflationary pressures.

In conclusion, banks with CRE concentrations are more likely to rely on brokered deposits and other borrowed money, adding additional risk to their enterprise. Banks with CRE concentrations, especially those who have grown their CRE book by more than 50 percent over the last three years, should conduct well-designed stress tests that incorporate both credit and liquidity risks. These banks should anticipate a deep focus on liquidity as well as credit in their next regulatory exam, requiring new tools to address this situation.

Schedule a consultative discussion

CECL Trends, CECL, community bank regulations, community banks, CECL Modeling, acl challenges, bank regulatory compliance, advanced cecl

Now that most community banks have eight to ten quarters of CECL experience under their belts, many are still grappling with foundational issues such as overreliance on qualitative factors, lack of responsiveness to risk rating...

capital planning, community bank regulations, Deregulation, bank strategy, community banks, regulatory capital, bank growth strategy, cre risk

Author : Adam Mustafa, CEO, Invictus Analytics

Community banks now have the clearest path in nearly two decades to reshape their regulatory capital requirements—and they shouldn't miss it. While most recent efforts to ease...