Invictus Tariff and Trade War Recession Scenario

The Invictus Tariff and Trade War Recession 2.0 scenario (updated August 19, 2025) is intended to reflect (but not predict) a tail-risk outcome for the U.S. economy, driven by...

Reporting on and understanding wildfire risks

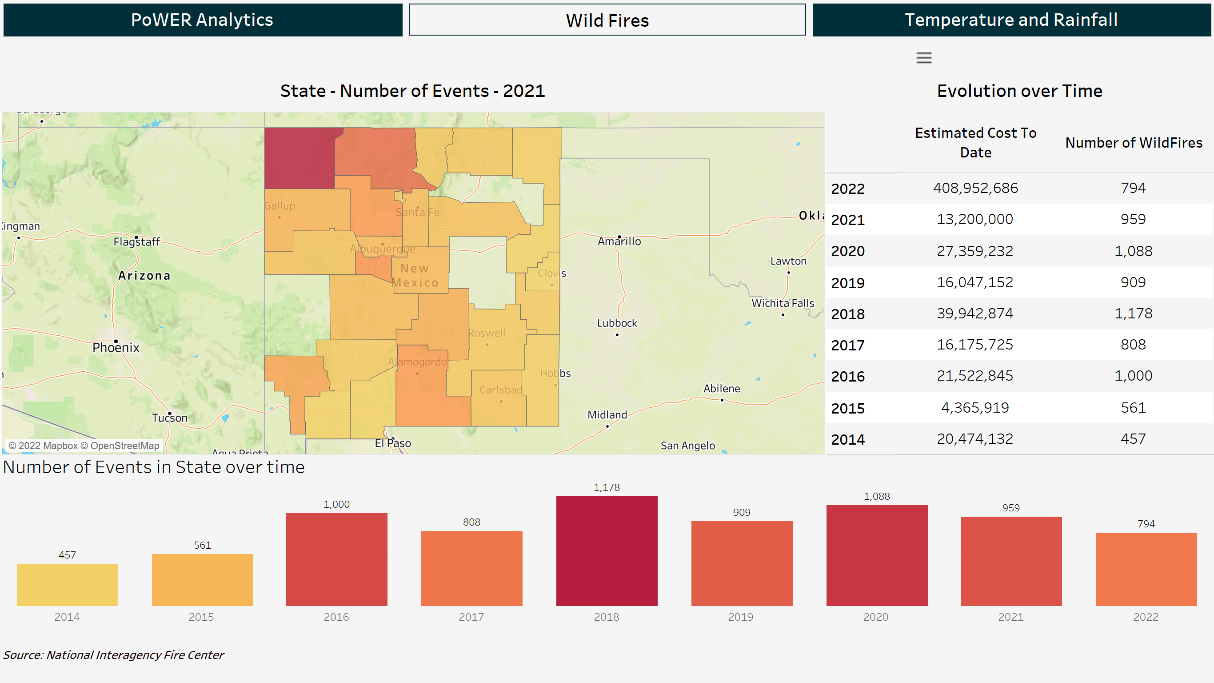

More than 7 million acres of land across the US burned in wildfires in 2022. The American West has been particularly hard hit, and New Mexico recorded two of its most serious wildfires on record.

There have been so many wildfires in recent years that the American Bankers Association maintains a web page to help banks prepare. Yet that won’t be enough to satisfy regulators, who are increasingly calling for community banks to understand the physical risks they face from climate change, such as more extreme weather events.

As a result of a changing climate, wildfire seasons have increased in duration, starting earlier in the spring, and often lasting well into the following winter. The frequency and severity of fires has increased as well. Higher temperatures are causing winter snow from mountain tops to melt earlier, reducing moisture in forest wood, which is nature’s defense to slow down fires once they start. All this increases the likelihood of economic damage.

This chart shows the frequency of recent wildfires in New Mexico.

Source: Invictus Portfolio Weather Event Risk (PoWER™) analytics

Source: Invictus Portfolio Weather Event Risk (PoWER™) analytics

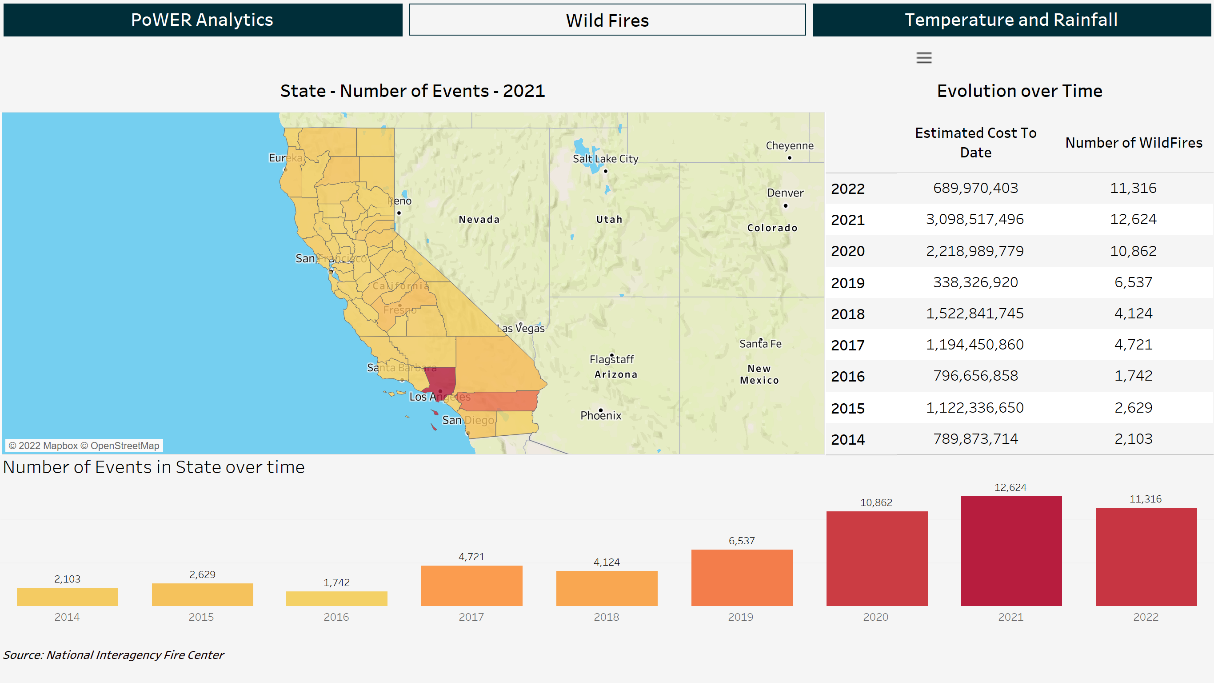

Warmer winters, coupled with increased high winds, is also drying out forest debris faster, which leads to more wildfires. California experienced its highest number of wildfire events on record in 2021, as the following chart shows.

Source: Invictus PoWER™ analytics

Source: Invictus PoWER™ analytics

Community banks, particularly in areas that have experienced wildfires, must anticipate more frequent and intense fires in the years to come. Locally, the fires burn through homes and crops, causing billions of dollars in economic damage. The fires not only impact the local communities through physical damage but can also cause respiratory issues for people who live in neighboring communities.

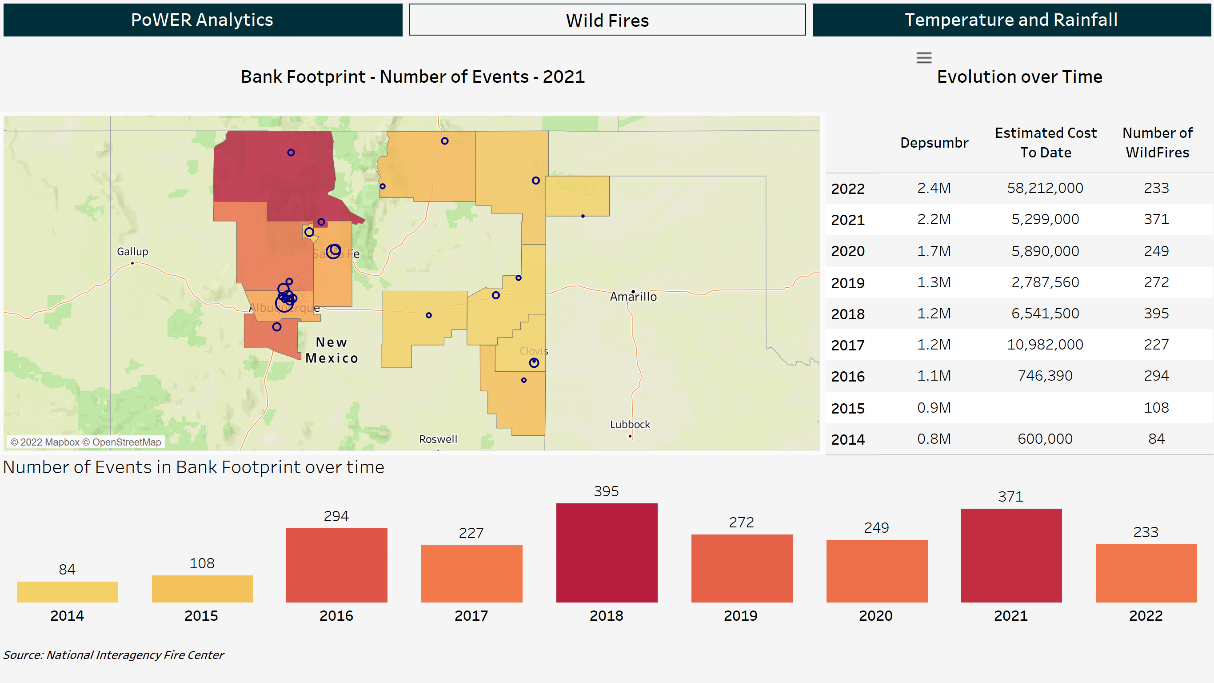

Let’s look at a hypothetical lending portfolio for a bank based in New Mexico.

Sample New Mexico bank lending portfolio

Source: Invictus PoWER™ analytics

Source: Invictus PoWER™ analytics

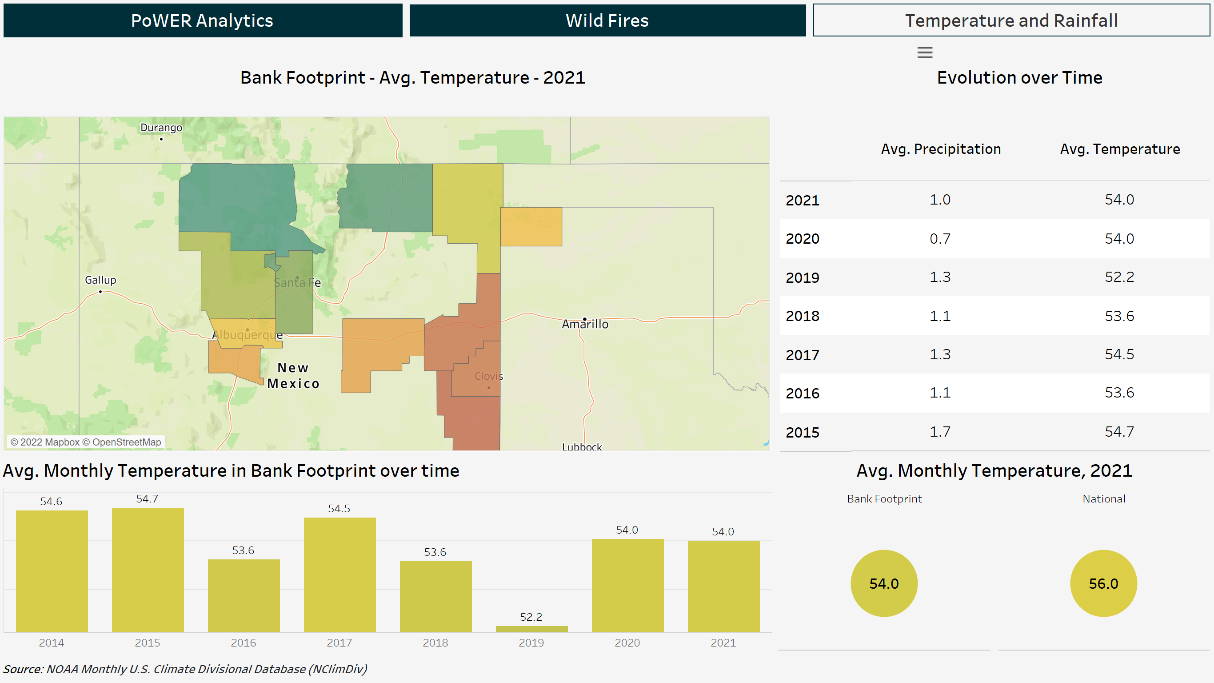

Average temperature trend for New Mexico

Source: Invictus PoWER™ analytics, NOAA

Source: Invictus PoWER™ analytics, NOAA

The analytics show an interesting snapshot of climate change risk. For this New Mexico bank, temperatures have been steadily increasing in its footprint, going back decades. The data also shows that wildfire frequency within the footprint is primarily concentrated in those counties with higher average temperatures, particularly in the state’s western region.

When we combine this information with other Invictus Portfolio Weather Event Risk Analysis (PoWER)™ analytics, we can see that the bank has a higher potential risk to wildfires relative to other banks in the US. The system can let the bank see how it fares compared with its peers in the state or whatever geographic region it wants to select. The bank can use this information as a starting point when regulators ask whether the bank is aware of the physical risks it faces from climate change.

Resistance to Risk Disclosures

Efforts to help homeowners asses their wildfire exposure risks this summer in Oregon did not go well. Homeowners were outraged when state officials released a map of every property in the state with its fire risk, arguing that it would lower their property values, increase their insurance rates, and mandate new regulation. The state withdrew the map.

Some community banks have had similar reactions to any efforts by regulators to impose new climate change requirements.

But as Mayer Brown bank lawyers noted in October 2022, “the FDIC now expects community and mid-size banks to develop climate-related financial risk management practices.”

The lawyers advised that community banks “begin to consider how climate-related financial risks affect their activities.”

In the past, most community banks have dealt with severe weather events easily, mainly because of government assistance through FEMA and insurance payouts that have made their customers whole. But with climate change increasing the number of severe weather events, officials are warning that insurance may no longer be available in the future. California cautioned property owners in 2018 that insurance companies were deciding that some properties in fire-prone areas were too risky to insure.

FDIC Acting Chairman Martin J. Gruenberg, who has been nominated for the top FDIC job, said in October that banks should “not be wholly dependent” on government assistance “whether directly or indirectly” when assessing future severe weather event risks.

The OCC has also called for community banks to begin assessing their climate change risks, as this white paper details.

Climate Risk Reporting

Historically, wildfires have been more prevalent in the western part of the U.S. But banks across the country need to be aware of these risks, especially as the banking market consolidates and banks move into new territories.

And wildfires are not the only climate risk that banks face. See our case study on flood risks, for example.

The Invictus PoWER™ analytics gives community banks a quick and easy way to assess how much of their portfolio is at high/medium/low risk to 18 different types of natural hazards, relative to all banks in the US.

By connecting diverse data sources, we are also able to pinpoint areas within a bank’s footprint that have been more prone to weather events over time. This information can be used to provide a richer narrative in a public bank’s disclosure statements, board reports, or examiner discussions. It also gives management new tools to assess emerging strategic risks in their footprint.

One of the essential roles of community bank management is to adequately price risk to support informed, efficient capital-allocation decisions. To carry out this function, banks need accurate and timely information.

Using loan-level data, the Invictus PoWER™ maps specific climate risks to geographic markets and displays them visually, allowing the C-Suite, boards, shareholders and regulators to see the potential impact on a bank’s portfolio and footprint.

To learn more about this product visit the climate risk analytics home page or contact climaterisk@invictusgrp.com

CECL Trends, CECL, community bank regulations, community banks, CECL Modeling, acl challenges, bank regulatory compliance, advanced cecl

Now that most community banks have eight to ten quarters of CECL experience under their belts, many are still grappling with foundational issues such as overreliance on qualitative factors, lack of responsiveness to risk rating...

capital planning, community bank regulations, Deregulation, bank strategy, community banks, regulatory capital, bank growth strategy, cre risk

Author : Adam Mustafa, CEO, Invictus Analytics

Community banks now have the clearest path in nearly two decades to reshape their regulatory capital requirements—and they shouldn't miss it. While most recent efforts to ease...