Invictus Tariff and Trade War Recession Scenario

The Invictus Tariff and Trade War Recession 2.0 scenario (updated August 19, 2025) is intended to reflect (but not predict) a tail-risk outcome for the U.S. economy, driven by...

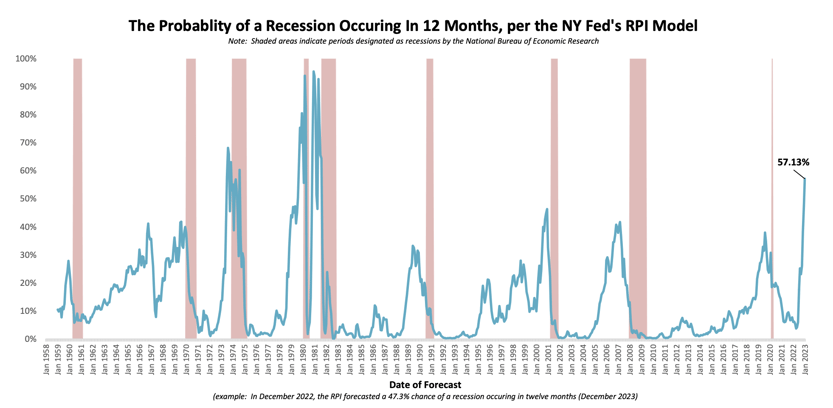

A key recession indicator is now at its highest point in 42 years.

Nobody has a crystal ball, but bankers need to always gauge the risk of an imminent recession. Well, there is a model that does precisely that, yet very few bankers are aware of its existence. The scariest part is according to this model the probability of a recession is the highest it has been in 42 years.

Source: Federal Reserve Bank of New York, The Yield Curve as a Leading Indicator, https://www.newyorkfed.org/research/capital_markets/ycfaq.html

The Federal Reserve Bank of New York has a model called the Recession Probability Indicator (“RPI”). This model estimates the probability of a recession over the next twelve months in the United States. The RPI is updated monthly, and usually within two weeks after month-end.

The model is driven by the spread between the market rates of the 10-year treasury bond and the 3-month treasury bill. While the shape and inversion of the yield curve is closely tracked by participants in the bond market, the New York Fed takes it a step further by synthesizing this information into a specific probability percentage, which makes it more useful to management teams and directors of financial institutions.

The RPI, as is true for any model, is far from perfect. It can be vulnerable to the old running joke on Wall Street that the “market has predicted nine of the last five recessions”. It also does not provide insight on the severity of the recession it is predicting.

Still, the RPI has proven to be quite effective in projecting recessions two to six quarters in advance of their occurrence. This includes the recessions of the early 1980s, early 1990s, the 2001 Dot.com / September 11th recession and the 2008 Global Financial Crisis.

The RPI was also accurate in terms of forecasting the recession in 2020; it was screaming that the probability of a recession was relatively high in August 2019. Of course, there was no way of predicting the pandemic, but a recession ended up occurring, nevertheless.

According to the RPI as of January 31, 2023, there is a 57 percent chance of a recession occurring over the next twelve months. While the looming threat of a recession is perhaps not a surprise to most, this print is quite shocking from a historical perspective.

The RPI reading as of January was the highest it has been since August of 1981, which was 64 percent. This reading topped both peaks prior to the 2008 Global Financial Crisis (42 percent as of March 2007) and the 2001 Dot.com / September 11th recession (46 percent in December 2000). It’s also the 30th highest print out of the 780 prints in the history of the model, which goes as far back as 1958.

The probability of a recession occurring in the near future is of obvious importance to financial institutions. Management teams should start tracking the RPI and sharing it with their boards. Given the most recent print, strategic plans should include contingency action planning. Capital plans need to be updated to ensure that the institutions ‘guardrails’ are primed to handle a potential downturn. Thanks to the new CECL standard, financial institutions should also adjust their loan loss allowances for deteriorating forecast environments.

This is the time to get serious about capital planning. A big part of updating the capital plan entails stress testing your loan books, liquidity, and capital. And this must be done with intent, not as a top-down superficial exercise. Stress test results should then be used to create, adjust, or validate the triggers and limits for all your regulatory capital ratios and key risk indicators in your capital plan. Your contingency plans should be “on deck” and evaluated for effectiveness, just in case.

Your strategic plan is your playbook for offense, but your capital plan is your playbook for defense. In good times, it’s easy to de-prioritize the capital plan and treat it as “check the box”. According the RPI, there is nearly a one out of two chance of a bad outcome in the economy over the next twelve months. Is your defensive playbook ready?

Invictus Group assists financial institutions with writing capital plans, stress testing, and both identifying and quantifying limits and triggers for key ratios which are customized to the bank. For more information on these services, please contact Patti Casaleggio at pcasaleggio@invictusgrp.com.

CECL Trends, CECL, community bank regulations, community banks, CECL Modeling, acl challenges, bank regulatory compliance, advanced cecl

Now that most community banks have eight to ten quarters of CECL experience under their belts, many are still grappling with foundational issues such as overreliance on qualitative factors, lack of responsiveness to risk rating...

capital planning, community bank regulations, Deregulation, bank strategy, community banks, regulatory capital, bank growth strategy, cre risk

Author : Adam Mustafa, CEO, Invictus Analytics

Community banks now have the clearest path in nearly two decades to reshape their regulatory capital requirements—and they shouldn't miss it. While most recent efforts to ease...