Invictus Intel Blog

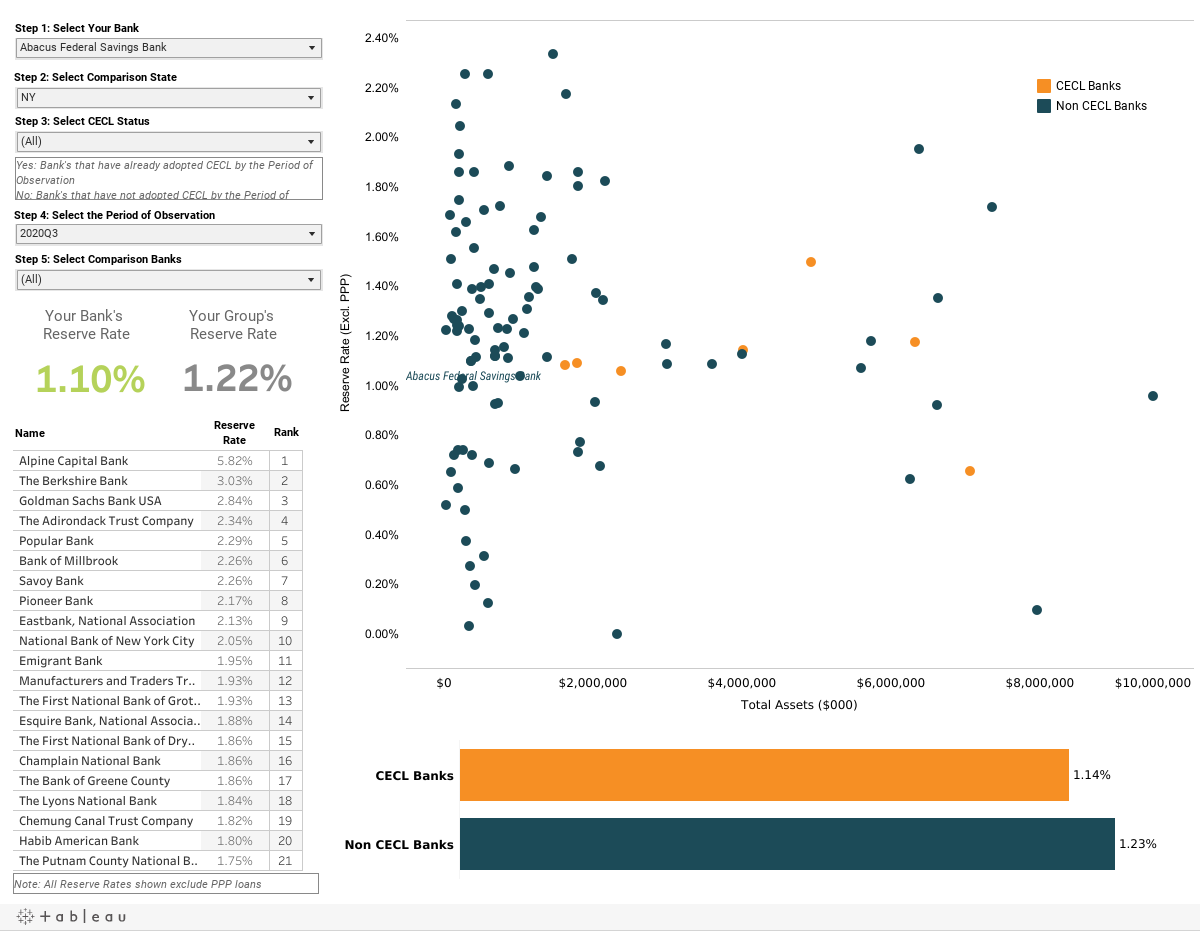

Free Data Tool: Analysis of 3rd Quarter Loan Loss Reserves for U.S. Community Banks

CECL May Not Increase Loan Loss Reserves—And Other Myths for 2023 Filers

The Problem with CECL Models: You’re Asking the Wrong Question

How to Communicate Your Bank’s CECL Findings to Investors

CECL vs COVID: Q1 Data Reveals What Drove Loan Loss Reserves for Publicly Traded Banks

Let’s face it: Publicly traded banks that implemented the new current expected credit losses (CECL) accounting standard during the COVID-19 pandemic faced a huge set of challenges. But what really drove their decisions about how...

Coronavirus Relief Bill Lowers Community Bank Leverage Ratio, Delays CECL for All Banks

The final version of the $2.2 trillion coronavirus relief bill passed by the U.S. Senate would make life easier for community banks this year. The bill temporarily lowers the community bank leverage ratio to 8 percent and...

How Much Better Will Banks Be if CECL Dies? The Answer Might Surprise You

The Federal Deposit Insurance Corp. this week did something unusual: FDIC chair Jelena McWilliams sent a letter to the Financial Accounting Standards Board, asking it to delay implementing the current expected credit loss (CECL)...

Coronavirus + CECL = Earnings Nightmare

If we do not get a miracle turnaround with respect to the coronavirus and its impact on markets, the first quarter earnings for most publicly traded community banks (SEC filers) is going to be a disaster because of CECL. In fact,...

You’ve Been WARMED: Why SEC Filers Should be Leery of the WARM Method for CECL

Earlier this month, FASB published a Q&A related to the applicability of the Weighted Average Remaining Maturity (WARM) Method for CECL compliance. This method is widely considered to be the simplest approach to CECL since it...