Invictus Intel Blog

How to Break Through the Concentration Limit Ceiling

The Business Case for Dynamic Concentration Risk Management

Say goodbye to the days in which concentration risk management was as simple as assigning an arbitrary limit to commercial real estate and construction loans and calling it a day. Concentration risk management is rapidly becoming...

How the Pandemic Has Changed the Nature of Managing Concentrations

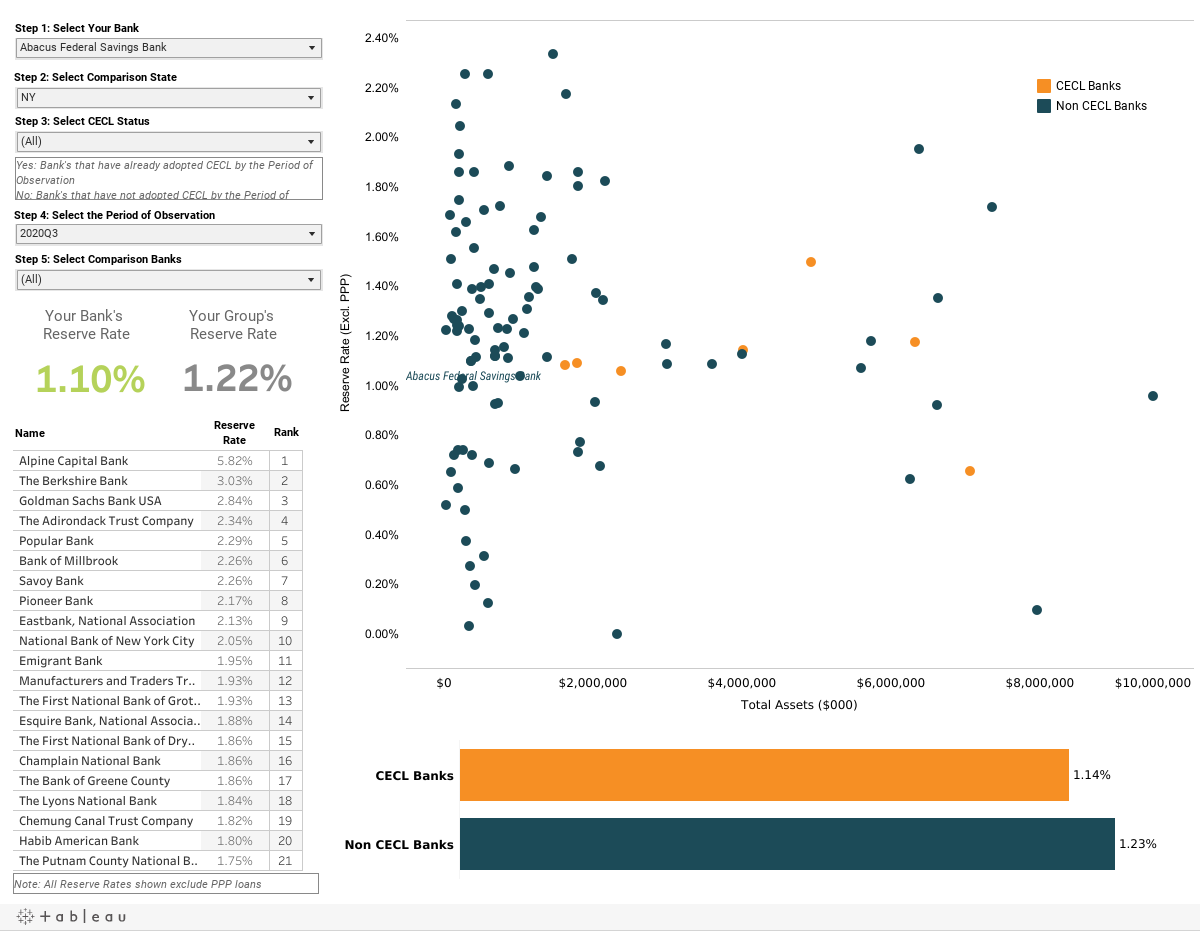

Integrating Critical Processes to Unlock Strategic Value from CECL

Although the new accounting standard known as CECL is a requirement, bankers need to stop viewing it through that lens. CECL has many silver linings.

Caveat Emptor: The Pitfalls of a SaaS Approach to CECL

Software can be wonderful. It can provide a spike in efficiency and automate a host of processes and problems that were previously solved manually in painstaking fashion. As a result, it is no surprise that many community banks...

Picking a CECL Methodology: Five Reasons Why Only One Method Makes Sense

FASB’s guidance for CECL is flexible when it comes to methodologies. In fact, many software-as-a-service (SaaS) providers and consultants make it a point to brag how their products can handle just about all of them. But let’s not...

News Alert: Regulatory Advice on What Banks Should Do in 2021

With the economic impact of the coronavirus still masked by relief efforts, community banks should act conservatively in 2021, making sure their banks have proper risk management processes in place to guard against additional...