As global greenhouse gas emissions soar to unprecedented levels and the world grapples with the urgent need to address smoking skies, the implications for financial institutions, including community banks, cannot be ignored....

Invictus Intel Blog

11 Observations from the Regulatory Exam Trenches

Safety and soundness exams are the toughest they have been in years

It has been over four months since the collapse of Silicon Valley Bank. It seemed obvious at the time that regulators were going to change their posture towards...

7 SVB Failure Community Bank Ramifications: Liquidity is Now King

Every bank needs to reassess to their strategic and capital plans because of this past week’s events. Optimizing self-sustaining liquidity levels and real capital levels should be the highest priority right now.

Your Capital Plan Is Your Defensive Playbook: Is It Ready for a Recession?

A key recession indicator is now at its highest point in 42 years.

Regulators Want to See Your Capital Plan, This Time it Better be Good

Regulators are more concerned about capital in the banking industry than at any point since the 2008 Financial Crisis. This includes the 2020 Pandemic which saw regulators go out of their way to help banks handwave away concerns...

Get Ready for Tough Concentration Questions at your Next Bank Exam

No matter the regulator, community banks with concentration issues should expect extra scrutiny at their next exam. Banks without proper concentration risk management processes are in danger of CAMELS downgrades, enforcement...

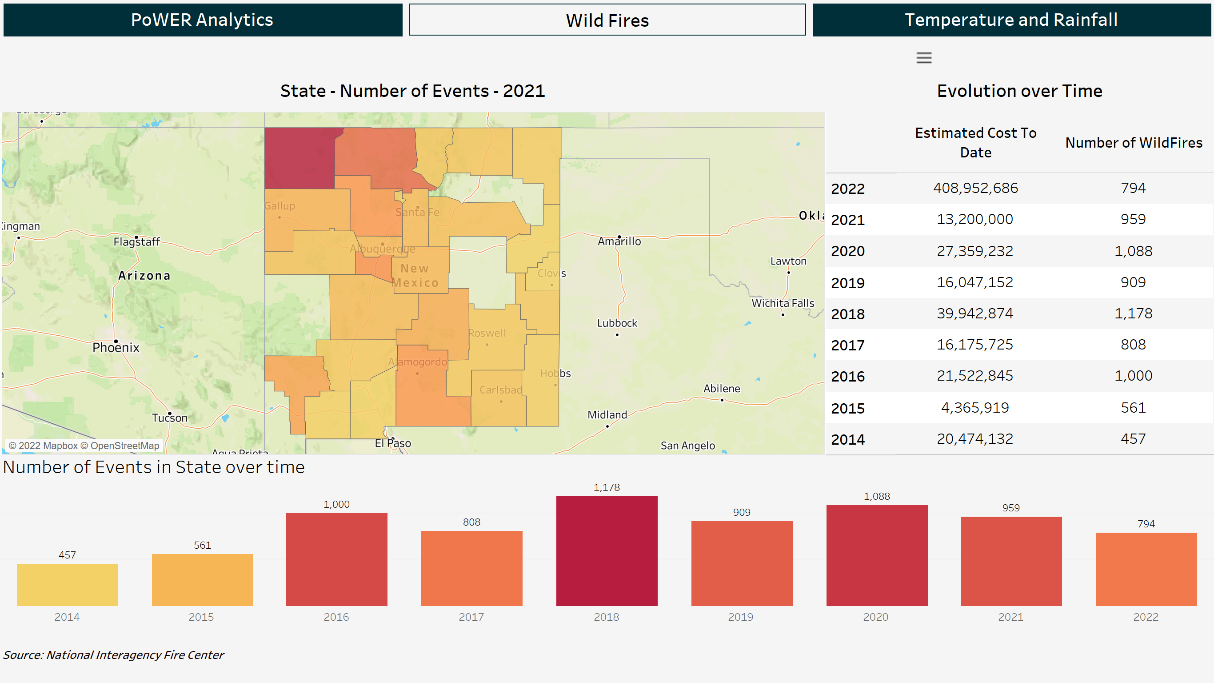

Wildfires and Loan Portfolios: How Financial Institutions Can Mitigate Climate Risk

Reporting on and understanding wildfire risks

What Every Community Bank with a CRE Concentration Needs to Do Before March

If you work for a bank that has a CRE or construction concentration, you most likely know that regulators have you in their cross hairs. I’ve seen several instances over the last few weeks in which examiners have notified banks...

Regulators Double Down on Need for Community Bank Climate Risk Management

Both the FDIC and the OCC have signaled in recent weeks that they expect community banks to begin understanding their climate-related risks “in the near term.”

-1.jpg)