Invictus Tariff and Trade War Recession Scenario

The Invictus Tariff and Trade War Recession 2.0 scenario (updated August 19, 2025) is intended to reflect (but not predict) a tail-risk outcome for the U.S. economy, driven by...

By Álvaro Espitia and Avik Ray

Crop insurance indemnities have risen due to the worsening effects of climate change, including droughts and floods. This trend is incredibly challenging for farmers who grow commodities like corn, soybeans, wheat, and cotton. For Community Banks that work with clients in the agricultural sector, this is a key risk that needs to be considered when looking at business continuity and the ability to repay loans.

Crop insurance indemnities are payments made to farmers by insurance companies when their crops are lost or damaged due to natural disasters, pests, or other events that are covered under the insurance policy. These payments help farmers recover some of their losses and provide a safety net to manage risk. However, crop insurance indemnities can vary depending on the type of policy, the crop, the location, and the extent of the damage. By looking at the annual trends, we can see the increasing financial risks to the sector arising from climate-related events.

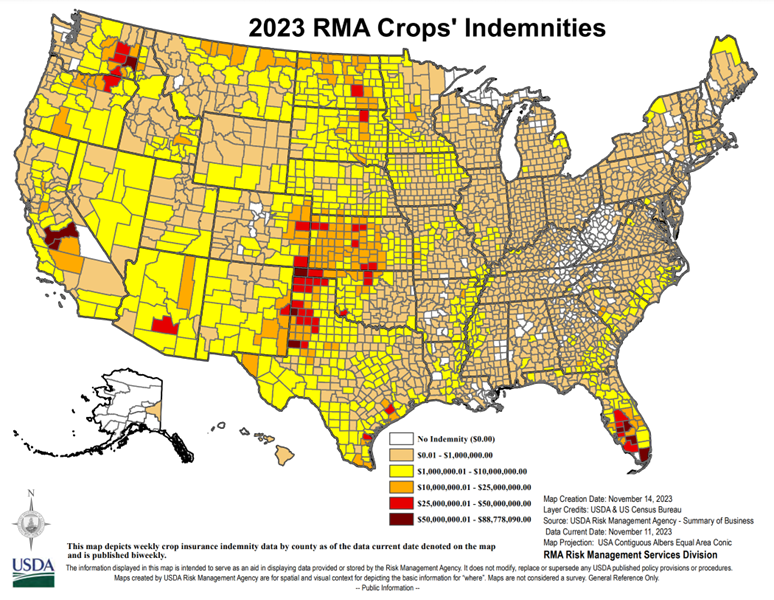

According to the USDA’s Risk Management Agency (RMA), as of November 20, 2023, total crop indemnities have totaled $19.12 billion in the 2023 crop year, approaching the 2022 record high of $19.13 billion. Payments have been concentrated in a few counties. Figure 1 shows the 2023 RMA Crops’ Indemnities as of November 2023.

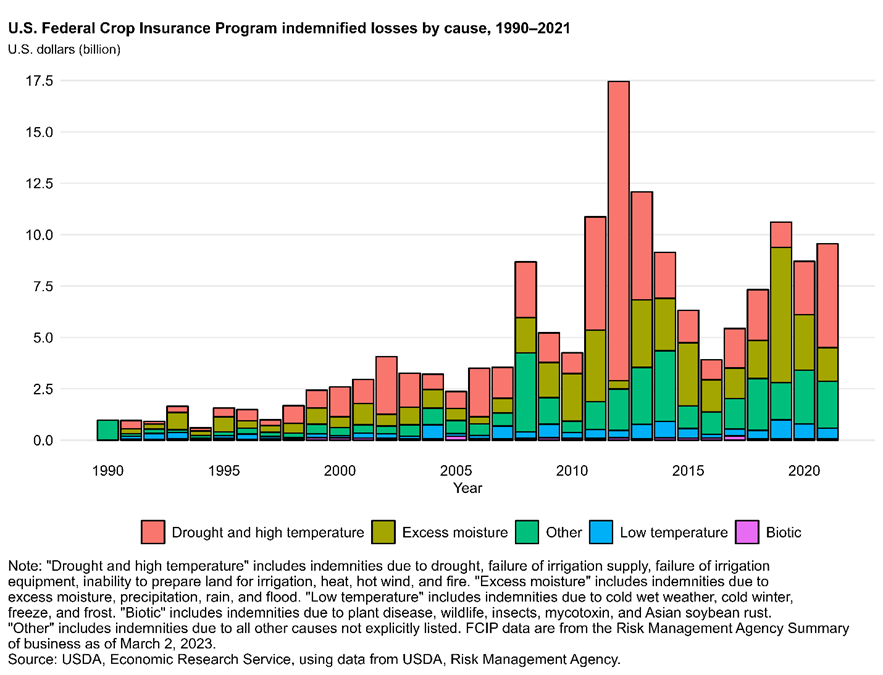

The magnitude of FCIP indemnified losses can be influenced by various factors, including changes in producers’ demand for crop insurance, extreme weather events, and changes in crop values over time. According to the Environmental Working Group (EWG), indemnities paid to farmers for reductions in crop yield or revenue have increased significantly during the last 20 years (over 500 percent), from $2.96 billion in 2001 to a record $19.13 billion in 2022. Many of these payments were made for weather-related losses, undisputedly linking rising crop insurance costs to climate change. Since 2000, annual indemnity payments have increased by 15.8 percent per year. Although there is year-to-year variation due to prevailing weather conditions, drought has consistently been a leading cause of indemnified losses. Since 2000, 42.1 percent of total indemnity payments were for losses attributed to drought or high temperature. Excess moisture is also frequently responsible for large indemnities—27.5 percent of total indemnity payments since 2000.

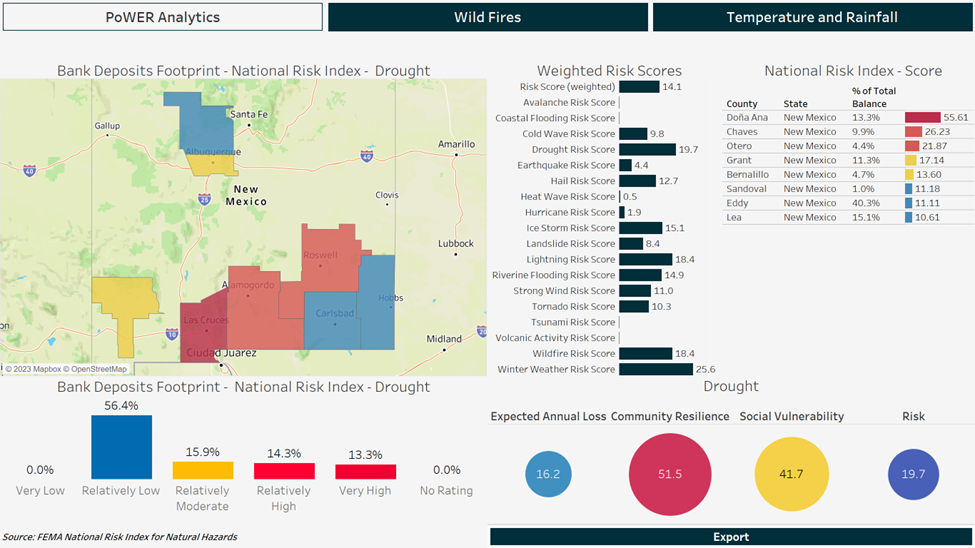

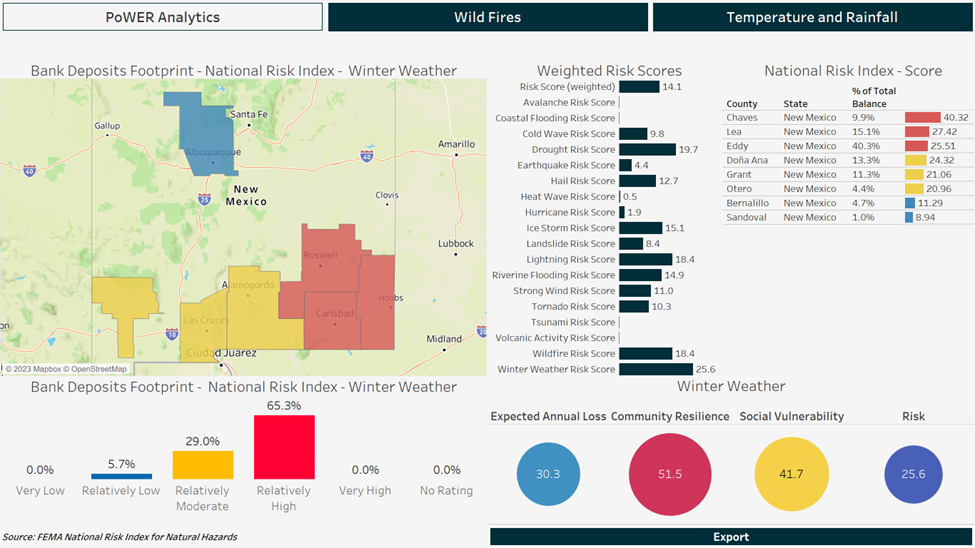

Invictus Portfolio Weather Event Risk (PoWER) analytics is a tool that can help community banks, farmers, and other stakeholders in the agricultural industry understand the natural risks that they face. The Invictus system provides information on the relative risk and severity of natural disasters, such as droughts and cold waves, among others, in a given area. This information lets stakeholders make informed decisions about crop insurance policies and risk management strategies.

Invictus POWER analytics uses data on 18 different types of climate related risks and overlays a bank’s lending footprint on the likelihood and severity of natural disasters in a given area and climate data, allowing the executive team and board to create a visual portrait of their climate-related physical risks. Commodities like corn, soybeans, wheat, and cotton highlight the challenges of changing weather patterns.

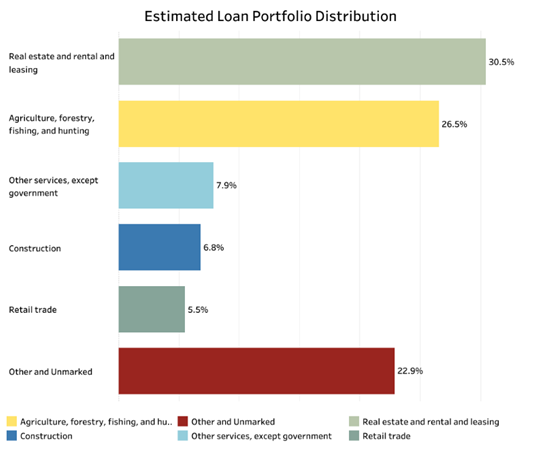

Let's look at an example of a hypothetical $800-million-bank based in New Mexico, with loans distributed across the state and a concentration of exposure to the Agricultural sector. We can quantify the exposure of loans to different forms of natural hazards regarding their historical impact. According to the bank´s footprint, we can estimate that nearly one-quarter of its loans are in the agriculture, forestry, fishing, and hunting industries, which poses a high risk of suffering from adverse climate situations.

Given the nature of the events and data limitations, it is not possible to predict the probability of future extreme weather events with sufficient accuracy, but this exercise is a practical first step for community banks as it helps them begin to understand and evaluate their exposure.

The results show that loans made in the southern region are more exposed to drought risk, with 27.6 percent of the bank´s loan portfolio in relatively high and very high risk for losses due to droughts. Similarly, the same bank´s exposure to winter weather shows that 65.3 percent of the portfolio is at a relatively high loss risk.

These analytics can help Community Banks make informed decisions around their lending activities, considering any safeguards that would need to be in place for lending to the Agricultural sector in these locations, protecting their clients, their bank, and their shareholders from climate-related financial risks.

If you would like to learn more about how PoWER analytics could help your bank to understand their climate related risks, please contact climate@invictusgrp.com.

CECL Trends, CECL, community bank regulations, community banks, CECL Modeling, acl challenges, bank regulatory compliance, advanced cecl

Now that most community banks have eight to ten quarters of CECL experience under their belts, many are still grappling with foundational issues such as overreliance on qualitative factors, lack of responsiveness to risk rating...

capital planning, community bank regulations, Deregulation, bank strategy, community banks, regulatory capital, bank growth strategy, cre risk

Author : Adam Mustafa, CEO, Invictus Analytics

Community banks now have the clearest path in nearly two decades to reshape their regulatory capital requirements—and they shouldn't miss it. While most recent efforts to ease...