With the economic impact of the coronavirus still masked by relief efforts, community banks should act conservatively in 2021, making sure their banks have proper risk management processes in place to guard against additional...

Invictus Intel Blog

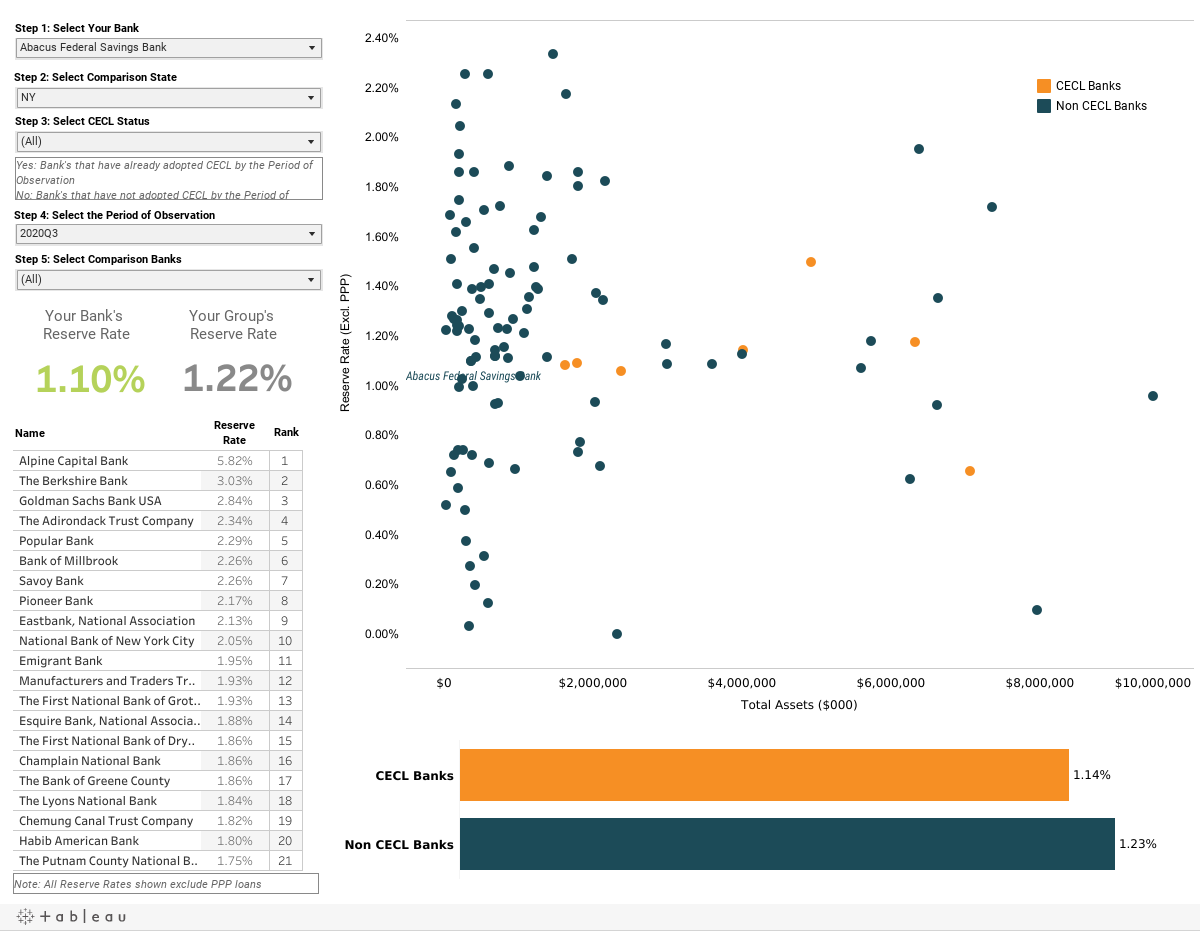

Free Data Tool: Analysis of 3rd Quarter Loan Loss Reserves for U.S. Community Banks

Check out this new Invictus Group tool, which will help you do just that. The tool includes data for the quarter ending September 30, 2020 back to the fourth quarter of 2019.

CECL May Not Increase Loan Loss Reserves—And Other Myths for 2023 Filers

The 2023 class of CECL banks is being unnecessarily conditioned to a false reality: Their loan loss reserve will need to increase under CECL. If CECL is approached correctly, this is simply not true, unless the probability that a...

The Problem with CECL Models: You’re Asking the Wrong Question

If your bank is scheduled to implement CECL in 2023, or you’re a CECL filer unhappy with your existing model, here is my strongest piece of advice: Stop looking for a “CECL” model. What you really need is a CECL process that is...

Lessons from the Field: How Three $1B+ Community Banks Are Using Pandemic Stress Testing to Manage Strategy, Risk and Capital

Pandemic stress tests are helping banks manage concentrations, while also reassuring boards and management teams that they can withstand the economic fallout from the coronavirus, three community bankers revealed on a December 3rd

How to Communicate Your Bank’s CECL Findings to Investors

Although the deadline for CECL implementation for many community banks has been postponed until 2023, larger banks across the country are already using the new accounting standard. Their experiences will provide lessons for the...

FDIC Says Worst is Yet to Come, 1 out of 4 ‘Satisfactory’ Banks Hit with MRBAs

While community banks have so far weathered the coronavirus pandemic, Federal Deposit Insurance Corp. officials said in two recent advisory committee meetings that the worst is yet to come. And that means banks must begin...

Pandemic Stress Testing Can Be an Investment with a Huge ROI

With the right approach, the potential Return on Investment (ROI) from pandemic stress testing is quite significant. Most community banks treat stress testing as a check-the-box exercise when they should be viewing it as a...

M&A Hunting Season: Why the Pandemic is a Perfect Time to Target Acquisitions

As crazy as it sounds, now is an ideal time to be on the M&A hunt for community banks. It comes down to supply and demand. The supply of willing sellers is likely to increase as management teams and boards grapple with the...